iowa inheritance tax return schedules

An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent. For estates of decedents dying on or after July 1 1983 the preliminary inheritance tax return is abolished and a single inheritance tax.

The Estate Tax And Real Estate Eye On Housing

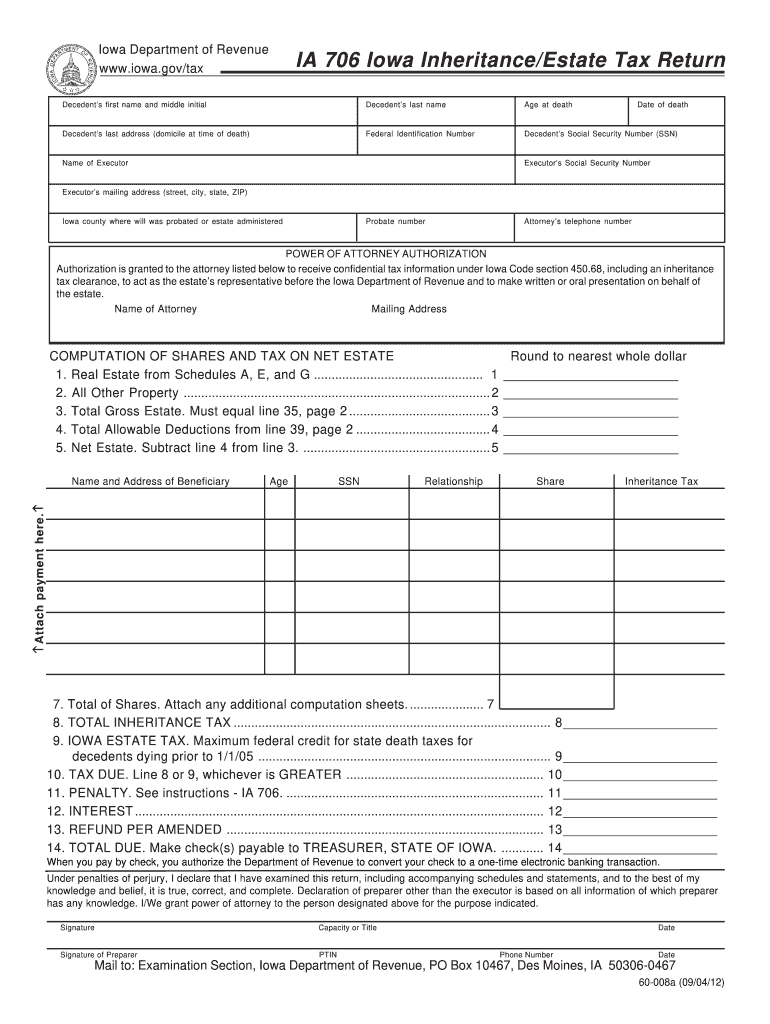

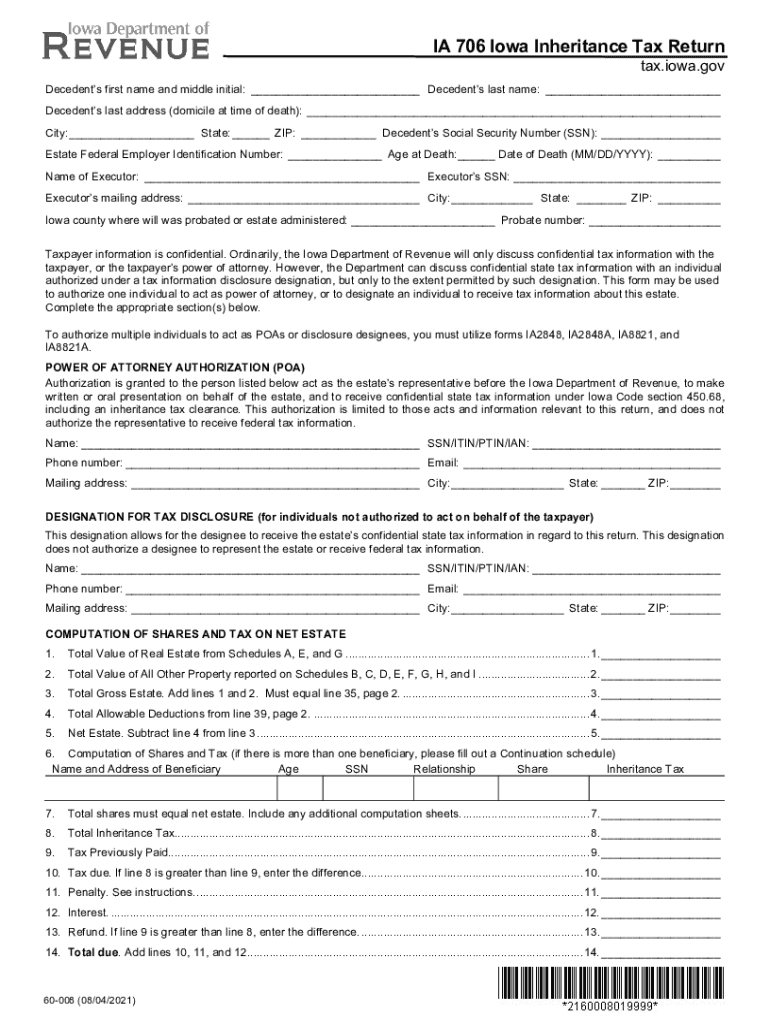

Iowa InheritanceEstate Tax Return IA 706 Step 1.

. Inheritance Deferral of Tax 60-038. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Department forms must be used for the Iowa inheritance tax return and Schedules J and K.

4504 additionally no inheritance tax return is required if the. While the top estate tax rate is 40 the average tax rate paid is just 17. This document is found on the website of the government of Iowa.

The inheritance tax return must be filed and any tax due must be paid on or before the last day of the ninth month after the death of the decedent or life tenant. Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. Read moreabout IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

The vast majority of estates 999 do not pay federal estate taxes. The estate tax is only paid on assets greater. Schedule B beneficiaries include siblings half.

A summary of the different categories is as follows. Estates of decedents dying on or after July 1 1983. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

If the net value of the decedents estate is less than 25000 then no tax is applied. If the federal estate tax return includes the schedules of assets and liabilities the taxpayer may omit Iowa Schedules A through I from the return. The Departments inheritance tax return and the liabilities Schedules J and K will be accepted.

Register for a Permit. While the top estate tax rate is 40 the average tax rate paid is just 17. 25001-75500 has an Iowa inheritance tax rate of 7.

Probate Form for use. 12501-25000 has an Iowa inheritance tax rate of 6. An extension of time to file the return and make.

Iowa Inheritance Tax Schedules. While the top estate tax rate is 40 the average tax rate paid is just 17. Learn About Property Tax.

While the top estate tax rate is 40 the average tax rate paid is just 17. List all property at fair market value except when special use or. Iowa does tax payments from retirement accounts like 401k plans and income from pension plans.

Register and Subscribe Now to work on your IA DoR Form 706 more fillable forms. Change or Cancel a Permit. Learn About Sales.

Track or File Rent Reimbursement. Iowa Inheritance Tax Schedules. The vast majority of estates 999 do not pay federal estate taxes.

However anyone 55 or older is eligible for a deduction of up to 6000. Read moreabout Inheritance Deferral of Tax 60-038. 0-12500 has an Iowa inheritance tax rate of 5.

To pay inheritance and estate tax in the state of Iowa file a form IA 706. An extension of time to file the. The estate tax is only paid on assets greater.

4504 additionally no inheritance tax return is required if the. If the estate has filed a federal estate tax return a copy must be submitted with the Iowa inheritance. If you wish to avoid an inheritance tax you can ensure that the net estate is valued at less than 25000.

Submitted with the Iowa return. An Iowa inheritance tax return must be filed and any tax due paid on or before the last day of the ninth month after the death of the decedent. An extension of time to file the return and make.

Inheritance Tax Rates Schedule. If the estate has filed a federal estate tax return a copy must be submitted with the Iowa return.

Gov Reynolds Signs Law Affecting Mental Health Funds Income Tax Cuts

.png)

Iowa Inheritance Tax Law Explained

Appliction For Refund Of Inheritance Or Estate Tax Rev 1313 Pdf Fpdf Docx

Video What Are Inheritance Taxes Turbotax Tax Tips Videos

How To Pay Inheritance Tax With Pictures Wikihow Life

Ia 706 Iowa Inheritance Estate Tax Return Fill Out Sign Online Dochub

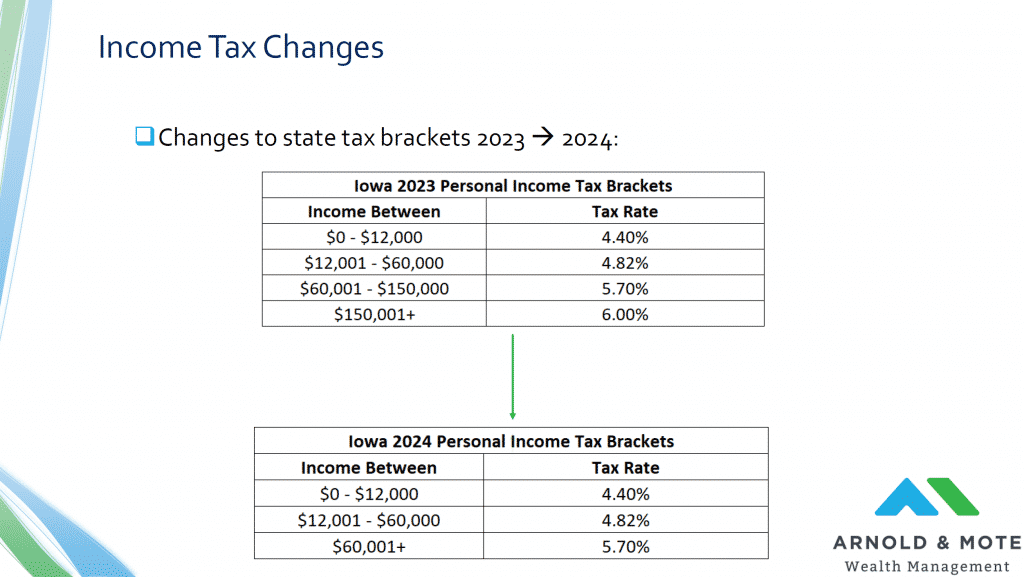

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

How Much Is Inheritance Tax Community Tax

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

2021 Form Ia Dor 706 Fill Online Printable Fillable Blank Pdffiller

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Which States Have Estate And Inheritance Taxes

Iowa State Back Taxes Understand Tax Relief Options And Consequences

Managing For Today And Tomorrow Business Succession Retirement And Estate Planning For Farm And Ranch Women Iowa Inheritance Tax Eliminated In 1996 For Ppt Download

Is There An Inheritance Tax In Kansas Estate Planning Attorneys In Missouri And Kansas

Iowa 706 Schedule J Fill Online Printable Fillable Blank Pdffiller

How Much Is Inheritance Tax Community Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center